Friday, February 22, 2008

Inflation of 100,000% is Possible

Latest inflation figure was estimated at 100,000% (but compared against which year?). When a country was required to print a larger currency denomination, which in this case was a 10,000,000 (Ten Million) Zimbabwe dollar note, it has sounded to the world that their smaller denomination notes were of no further use. Why was that so?

Previously bus fares were at Z$1.5m (that's in millions) and now, it's Z$3m. School teachers have to quit their jobs and took up menial jobs near their homes leaving schools without teachers in the new year.

A pair of branded lady shoes was selling at Z$150m in early 2008 but it went up to Z$450m lately.

You would be considered lucky if you could get a job which pays you Z$500m per month which worked out to US$100.

Banks have issued new rulings due to chronic shortage of cash:-

* staff who earn over Z$1m a month must be paid by cheques (where high bank charges would eat up a portion too).

* no cheques of Z$50m or above (US$416) are acknowledged by the banks and there are limits on the amount of cheques that can be drawn each day.

* only Z$3m (US$21) could be withdrawn from the ATM (per day I presumed).

In a way, that piece of 10,000,000 dollar note that was issued lately could be quite worthless. Such hyperinflation could happen when a government doesn't control their spendings and when cronies were the ones getting paid if ever spent by the government.

Related blog posting:

* Zimbabwe's 10,000,000 dollars note

* How High Can Inflation Hit Us? 100%? 100,000%?

* What's Happening to Zimbabwe?

Tags: Zimbabwe, Africa, Inflation, Hyperinflation, Economics, Zimbabwe Dollar

Monday, January 28, 2008

How an American Recession Might Hit Asia?

Decoupling was always a misnomer, seeming to imply that an American recession would have no impact on Asia. In fact exports and hence profits would certainly be reduced. The pertinent argument is that they would be hurt by much less than in previous American downturns. As well as hitting exports, America's troubles could affect Asia through various financial channels. Asia's exposure to the subprime mess is thought to be much smaller than that of American or European banks. Even so, Chinese bank shares tumbled this week on rumours that they would have to make much bigger write-downs on their holdings of American subprime securities. And if stockmarkets slide further as global investors flee from risky assets, this could dampen business and consumer confidence in the region.

Some Asian economies are more vulnerable than others: Singapore, Hong Kong and Malaysia have exports to America equivalent to 20% or more of their GDPs, compared with only 8% in China and 2% in India. There are already some ominous signs. Singapore's exports to America are down by 11% over the past year, while Malaysia's fell by 16%. Exports to other emerging economies and to the European Union surged, so total exports still grew by 6% in both economies. But that was much slower than at the start of the year, and the worry now is that demand from Europe has started to flag. The growth in China's exports to America slowed to only 1% (in yuan terms) in the year to December from over 20% in late 2006. So far the impact on GDP growth has been modest. Figures on China's fourth-quarter GDP were published on Thursday January 24th and showed growth above 11%.

China's economy would probably still expand by around 8-9% even if export growth dried up. During the 2001 American recession China's GDP barely slowed. In contrast, Hong Kong, Singapore, Taiwan and Malaysia suffered full-blown recessions. America's recession this time is likely to be deeper than in 2001 and Asia is now more integrated into the global economy. Doomsters conclude, therefore, that these economies could be hit harder this time. The main reason to be more optimistic is that domestic demand (consumer spending and investment) is likely to remain strong and governments have more flexibility. Last year, despite a slowdown in America's imports, most Asian economies grew faster as domestic demand speeded up. Robert Prior-Wandesforde, an economist at HSBC, says that those who argue that Asian economies cannot decouple from America are ignoring the fact that they already have. Take Malaysia: exports to America plunged, yet its GDP growth quickened from 5.7% at the end of 2006 to 6.7% in the third quarter of last year.

Contrary to the popular view that Asia's meltdown in 2001 was entirely due to a slump in exports, Peter Redward, at Barclays Capital, argues that a fall in investment played a bigger role. Firms had too much debt and excess capacity, particularly in the electronics sector, which was at the heart of the American recession. Today firms are in much better shape. Capacity utilisation is high across the region; outside China investment as a share of GDP is low by historical standards; corporate balance-sheets are stronger and real interest-rates are low. Firms are therefore much less likely to slash investment than in 2001. Macroeconomic fundamentals are also much healthier in East Asia. Large foreign-exchange reserves make countries less vulnerable to foreign shocks. Budgets are in surplus or close to balance, giving policymakers more room for a fiscal stimulus to support growth.

Thus even if Asia's exports clearly have not decoupled from America, its economies will be hurt less than in the past. Standard Chartered forecasts that emerging Asia will grow by an average of 6.4% in 2008, down from 7.8% in 2007. In 2001 growth dropped by three percentage points to 4.2%. Financial markets were slow to realise that Asian growth and hence the profits of some companies would be dented by an American downturn. But now they risk exaggerating the damage. Economic decoupling is not a myth.

Tags: Economics, American Recession, Asian Stockmarkets, Subprime Securities, Economic Decoupling

Sunday, November 25, 2007

Government Imposes National Savings

In Iran, the government has an idea that will surely drive their message far across all walks of life.

Tags: National Savings, Bank, Iran

Thursday, November 01, 2007

Spiralling Food Prices

* Russia plans this week to impose Soviet-style price controls on a range of foodstuff to soften the blow ahead of parliamentary elections in December.

The government has signed an agreement with major food retail chains and producers to freeze prices on staples such as milk, eggs, sour cream, bread, sunflower oil, sugar and salt. They have also introduced export duties on wheat and barley.

* Ukraine is considering export quotas on wheat, corn and barley.

* China has released stockpiles of pork and is considering doing the same for vegetable oil and grain.

* Bangladesh, Jordan and Egypt, which suffered 'bread intifada riots' in the 1970s, are raising subsidies or slashing import tariffs.

* Argentina, where inflation this year is expected to be 8 per cent to 10 per cent, the government has struck accords with dozens of companies to control prices.

* Italy - Italian authorities opened an investigation into pasta manufacturers over alleged price fixing. Italian pasta makers have increased prices this year - expected to surge by 20 per cent by autumn - as durum wheat used for making the trademark Italian food nearly doubled in price.

* Japan - the government is also monitoring food prices. Marudai Food said two weeks ago it will raise the prices of its ham and sausages, following rivals Nippon Meat Packers and Itoham Foods. Instant noodle makers Nissin Food Products, House Foods and Sanyo Foods have also announced price increases last quarter.

And the oil price has hit a historic high of US$96 per barrel on 31 Oct 2007. Will the target price of US$100 per barrel materialise by year end, earlier than estimated?

Reading: UN warns of food inflation effects - Financial Times

Tags: Food Price, Food Inflation, Economics, Price Fixing, Export Quotas, Stockpiles, Import Tariffs, Export Duties

Friday, October 19, 2007

Foreseeable Increase in Daily Expenses

Starting with the petrol. It could shoot up above RM2.00 per litre from the current pricing of RM1.97. The last increase was a hefty RM0.30 per litre when oil price was US$70 per barrel. The oil price has since shot up to US$90 per barrel as of yesterday. It's targetted to hit US$100 per barrel by 2008.

Here’s a compilation of how the petrol price has increased over the decade in Malaysia:-

before the 90’s - RM 0.89

1990 - RM 1.10 (increased RM 0.21)

01/10/2000 - RM 1.20 (increased RM 0.10)

20/10/2001 - RM 1.30 (increased RM 0.10)

01/05/2002 - RM 1.32 (increased RM 0.02)

31/10/2002 - RM 1.33 (increased RM 0.01)

01/03/2003 - RM 1.35 (increased RM 0.02)

01/05/2004 - RM 1.37 (increased RM 0.02)

01/10/2004 - RM 1.42 (increased RM 0.05)

05/05/2005 - RM 1.52 (increased RM 0.10)

31/07/2005 - RM 1.62 (increased RM 0.10)

28/02/2006 - RM 1.92 (increased RM 0.30)

2007 - ????

(Extracted from Galvin Tan)

And on 18 Oct, Malaysia's Domestic Trade and Consumer Affairs Minister has re-iterated to the Malaysian public - "that the Government would keep its promise not to increase oil prices this year". So, be prepared for next year then!!!!!!

Next in line for an increase - Malaysia's Commercial Vehicle Licensing Board, had on 4 Oct 2007, stated that the Board is reviewing plans to allow for increase in taxi and bus fares respectively. The taxi operators had asked for 600% increase and bus operators had requested for a 100%. The Board said that, if approved, it could be implemented by 3rd quarter of 2008.

When transportation costs (am sure goods transportation companies will ask for it as well) increases, it will certainly cause a domino effect on almost any goods/materials/stuff in Malaysia as everything relied on transportation.

For Kuala Lumpur habitants, the City Hall Council may impose an entry fee if your vehicle enters the city centre. Apparently, it's to improve traffic conditions in the city centre. The proposal will be submitted to the Cabinet Committee early next year.

Tags: Transportation, Daily Expenses, Oil Price, Petrol, Domestic Trade and Consumer Affairs, Commercial Vehicle Licensing Board, Taxi Operators, Bus Operators, City Hall Council, Cabinet Committee

Saturday, September 29, 2007

Minimum Wage is Too High?

In Hong Kong, a Poverty Relief Group did a study with a university there and the professor suggested a minimum monthly wage of HK$6,000 (approx. RM2,700) be implemented. This gave a shock to many people in Hong Kong.

Newly graduated law students could only earn around HK$7,500 while ordinary degree holder may just get around HK$6,000. In that case, the students may think why do I need to study so hard. Dropping out of school and doing a simple job without much responsibilities could earn you a pay similar with a degree holder.

Can you beat that? A Malaysian with a simple lifestyle can survive with RM900 (US$257) but a Honkie requires around RM2,700 (US$771) to live in Hong Kong. 3 times higher??? Sometimes, if your country is so developed, it will cause hardship to those in the lower income group.

Tags: Malaysian Trades Union Congress, Poverty Relief Group, Hong Kong, Minimum Wage, Minimum Salary, Lower Income Group, Cost Of Living

Tuesday, September 25, 2007

Economic Freedom of the World

Economic Freedom of the World has issued their latest 2007 Annual Report showing Malaysia's position at no. 60 falling from no. 54. Another disgrace for our nation? Well, the government will dispute the findings again and say that even though the ranking has dropped, the individual components that made up the total score has increased (which is a fact) but why did our ranking dropped when our score has increased. One very good reason is that other countries have improved much much more than Malaysia thus leaving Malaysia behind .....

Economic Freedom of the World has issued their latest 2007 Annual Report showing Malaysia's position at no. 60 falling from no. 54. Another disgrace for our nation? Well, the government will dispute the findings again and say that even though the ranking has dropped, the individual components that made up the total score has increased (which is a fact) but why did our ranking dropped when our score has increased. One very good reason is that other countries have improved much much more than Malaysia thus leaving Malaysia behind .....This report measures each country's policies on how it encouraged economic freedom where the publisher, Fraser Institute, an independent think-tank based in Canada, based this report on 42 different measures before releasing an index for 141 countries.

One funny thing about this report. The 2007 Annual Report is actually reporting the situation in year 2005. Next year's report will report 2006's index then. A bit outdated, isn't it?

Tags: Economic Freedom of the World, Economic Freedom, Malaysia, Fraser Institute, Economics

Friday, August 24, 2007

How High Can Inflation Hit Us? 100%? 100,000%?

Should the shopkeepers / stalls /businesses continue to increase their prices in order to maintain their profit margins or just to barely survive?

Daily food consumption's pricing increased due to other factors which caused their cost to increase. These were the signs.

Unfortunately, Zimbabwe, located in Africa, is experiencing the same kind of economic situation if not, worse than Malaysia. My previous postings on Zimbabwe did mention that their inflation rates were around 2000% early this year and then shot up to the region of 3,700% in May/June later.

Today, it could have reached an unprecedented scenario where common folks like you and me wouldn't be able to survive in the land of Zimbabwe. Only the filthy rich people will live through it. The inflaton rate of today? 7,638%

What figure was that? Means to say that a loaf of bread that cost RM2.00 (US$0.57) in August 2006 would have cost RM152.76 (US$43.65) this morning. Will you buy that loaf of bread? You have to as other type of food would be beyond your financial capabilities. That's how bad it is in Zimbabwe now.

According to economists and International Monetary Fund, if the Zimbabwean government still ding dong on the economics situation and slow to respond, an inflation rate of 100,000% has been predicted. The country will be doomed by then.

Current steps taken by the government to arrest the inflation:-

* ordered shopkeepers to slash their prices and arrested anyone who has failed to obey

* ordered shopkeepers to slash their prices and arrested anyone who has failed to obey* a new 200,000 Zimbabwe dollar note was launched

* created a commission to find a way to control soaring living costs

Effects of the inflation:-

* estimated three million people fleeing the country for South Africa

* unemployment rate stands at about 80%

* are mass shortages of fuel and foodstuffs

* some producers, fearing making a loss, cut production, meaning the move exacerbated shortages, leaving shop shelves empty

Tags: Zimbabwe, Inflation, International Monetary Fund, Mass Shortage, Unemployment Rate, Economics, Economy, Africa, Zimbabwe Dollar

Sunday, August 12, 2007

Next Change - 'Higher Oil Price'

In a blog posting last year about Peak Oil, it was stated that oil price per barrel was targetted to hit US$100. Good thing it didn't but it did touch US$78 this year. In fact, oil prices have now been on a bull run for four years. This year alone, they are up nearly 30% (Business Week).

Following expected oil pricing:-

* There is market momentum, and the magic number now is $81.

* If we hit that, most people believe it'll head to $91 or higher."

* Some technical charts predict prices could hit $110 or $118 by the end of the year.

With the worldwide stock markets crumbling unexpectedly, interest rates would have to be raised as governments in Europe, Japan & USA pumped fundings to support the stock markets. Japan was supposed to raise its interest rates and with their increase, hot funds would be affected in Asian stock markets that would cause investors from Europe, Japan & USA to conduct profit-takings.

I'm not predicting the end of the world but economics do have its own cycles.

Tags: Oil Price, Peak Oil, Economics, Stock Market

Thursday, August 09, 2007

How Rich Are You Today?

Listing for multi-millionaires and billionaires are being published annually to record the rich people's monies and assets.

But what about people like you and me? Where do you stand in the listing?

But what about people like you and me? Where do you stand in the listing?For once, you can find out. Goto Global Rich List and key in your annual income (choose your currency) and then click 'Show me the money!' button and you'll see your world ranking soon and in which top percentage too!

Tags: Global Rich List, Millionaires, Billionaires, Rich, Bill Gates, Carlos Slim

Wednesday, July 25, 2007

Salary Review

What you need...

What you need... What you asked your Manager for...

What you asked your Manager for... What HR Promised...

What HR Promised... ... What you felt it as

... What you felt it as What you received...Before Tax

What you received...Before Tax What you received...After Tax

What you received...After TaxIs it the same throughout the world?

Tags: Salary Review, Human Resource, HR

Thursday, June 28, 2007

Bahrain Imposes Income Tax of 1%

And just this 1% income tax has triggered the following:-

* Workers in Bahrain are up in arms

* local newspapers inundated with letters protesting the scheme

* country’s trade union federation, the General Federation of Workers' Trade Unions in Bahrain, is reportedly unhappy with the situation

Bahrain is the first GCC nation to impose a tax on working folks. Do you need this uproar? Kuwait is to follow next. Working folks in certain countries are being taxed as high as 30%. This tax increase has something behind as well - it exempts military personnel and local and national elected officials. One thing that the public sector workers may not know yet - part of the agreement was to increase their pay by 15%. Wow!!!! A 1% income tax justifies a 15% pay increment?

Furthermore this income tax revenue would be used for at increasing employment opportunities for nationals and, as well as providing training programmes for job seekers, includes incentives for companies to employ Bahraini citizens such as additional financial and technical and to to fund unemployment benefits for its citizens. Selfish working folks?

Reading: Bahrain ministry defends salary tax - Arabian Business

Tags: Bahrain, Income Tax, Middle East, Gulf Cooperation Council, GCC, Gulf, Kuwait, Unemployment Benefits, General Federation of Workers' Trade Unions

Wednesday, May 23, 2007

The Banker and the Fisherman

An investment banker was at the pier of a small coastal village when a small boat with just one fisherman docked. Inside the small boat were several large yellow fin tuna. The banker complimented the fisherman on the quality of his fish and asked how long it took to catch them.

The fisherman replied, "Only a little while." The banker then asked, "Why didn't you stay out longer and catch more fish?"

The fisherman said, "With this I have more than enough to support my family's needs."

The banker then asked, "But what do you do with the rest of your time?"

The fisherman said, "I sleep late, fish a little, play with my children, go for walks with my wife, stroll into the village each evening where I sip wine and play guitar with my friends. As you can see, I have a full and busy life."

The banker scoffed, "I am a Harvard MBA and could help you. You should spend more time fishing; and with the proceeds, buy a bigger boat! With the proceeds from the bigger boat you could buy several boats. Eventually you would have a fleet of fishing boats. Instead of selling your catch to a middleman you would sell directly to the processor, eventually opening your own cannery. You would control the product, processing and distribution. You would need to leave this small coastal fishing village and move to the capital city. After that, who knows, maybe you could take on the world!"

The fisherman asked, "But, how long will this all take?"

To which the banker replied, "I'd say about 15 to 20 years."

"But what then?" asked the fisherman.

The Banker laughed and said, "That's the best part! When the time is right, you would announce an IPO and sell your company stock to the public and become very rich, you would make millions."

"Millions?...Then what?" the fisherman continued prodding.

The banker said, "Then you would retire. Move to a small coastal fishing village where you would sleep late, fish a little, play with your kids, go for romantic walks with your wife, and in the evenings you could sip wine, play guitar and sing songs with your friends!"

To which the fisherman mused, "Now isn't that strange? Isn't that what I'm doing now?"

Important thing is to know what you want in life right from the beginning and you won't go wrong with it. Begin your life with the end in mind.

Tags: Investment Banker, Fisherman

Friday, April 27, 2007

Zimbabwe Inflation Reaches 2,200%

1 the action of inflating or the condition of being inflated.

2 Economics a general increase in prices and fall in the purchasing value of money.

In Zimbabwe, a nation at the southern African continent, it's inflation rate has reached a record 2,200% in March due to economic destability coupled with political crisis. That's what could happen to a country when it's not stable. Malaysia's political people tend to play with fire, trying to ignite various issues and blamed it on racial. Or setting up terms and conditions on racial terms. Imagine your plate of 'nasi lemak' could rise up to RM44.00 from RM2.00. But your salary MAINTAINS!!!!!!!

Zimbabwe's banks' secured interest rates would rise to 600%, up from the current rate of 500%. Malaysia's current banking rates at the moment is around 6% to 7%. Imagine if it jumps up by 100%, current monthly repayment of RM1,000 will be come RM2,000 in no time. A 600% jump???? (source: BBC News/Africa)

As what the Malaysia's new king said yesterday "Stay united / We must maintain this precious unity to the best of our ability".

Tags: Zimbabwe, Inflation, Economics, Purchasing Value

Friday, December 15, 2006

Rate of Increase for Highway Tolls

Nevertheless, this drastic increase will definitely put cause a high increase in cost of living to all people living in the Klang Valley. The Malaysian newspapers have been directed to tone down on the reporting of the toll hike so as not to incur the public wrath.

Recent months, the water and electricity authorities have increased their rates too. What next?

Tags: Toll, Highway, Transport, LDP, Kesas, Cheras-Kajang, KL-Karak, Guthrie Corridor

Monday, November 27, 2006

Increase of Toll Rates Confirmed !!

ONLY YESTERDAY (Sunday) - The Cabinet will decide by the end of this year whether to increase the toll charges for the five concessionaires. The concessionaires are Guthrie Corridor, KL-Karak Highway, Grand Saga, Lebuhraya Damansara Perdana and Lebuhraya Shah Alam.

Works Minister Datuk Seri S. Samy Vellu said the concession agreements would be due by Jan 1 next year. “I have submitted the working papers to the Treasury, the Economic Planning Unit and the Attorney General to get their feedback,” he said.

“Once my ministry receives the feedback, the Cabinet will decide whether to increase the toll.” He added that the Government would have to pay compensation to the concessionaires if they decide not to increase the toll. “The agreement lapses every three to seven years, so we will have to review the toll. If we do not allow them to increase the toll, then we will have to compensate them,” he told reporters at the Parliament lobby here yesterday. (source: The Star)

Tags: Toll, Highway, Lebuh Raya

Sunday, November 05, 2006

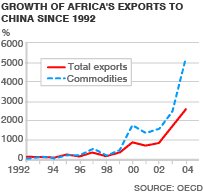

China-Africa Summit 2006

China has pledged to double its aid to Africa and provide $5bn in loans and credits over the next three years as announced in a summit attended by nearly 50 African heads of state and ministers. The 3 days summit is focusing on business with more than 2,000 deals under discussion (WOW!).

China has pledged to double its aid to Africa and provide $5bn in loans and credits over the next three years as announced in a summit attended by nearly 50 African heads of state and ministers. The 3 days summit is focusing on business with more than 2,000 deals under discussion (WOW!).

China's drive to buy African oil and other commodities has led to a big increase in two-way trade, worth $42bn (£22bn) in 2005 with China importing 38 million tonnes of crude oil from the continent in 2005 and has made major investments in oil and gas projects in countries including Kenya, Angola and Nigeria. China needs Africa's ample/rich supplies of natural resources and raw materials to fuel its surging economy and in return, invests in African roads, railways and other infrastructure.

Often, Chinese money is funding projects that western investors had deemed too risky (source: BBC News & China Daily). When you are in Sudan, you could numerous number of people from China itself. China government-owned companies were already in Sudan since 1990s.

Five countries in the Africa continent, namely Gambia, Malawi, Burkina Faso, Swaziland and Sao Tome have formal links with Taiwan, which China regards as a breakaway renegade province rather than an independent state. China has said that the five countries are welcome to send observers to the Sino-African summit, though they remain ineligible to join in the Sino-African strategic economic partnership as long as they continue to recognise Taiwan.

Tags: China, Africa, Business, Summit, Trade

Friday, October 27, 2006

Least Expensive City

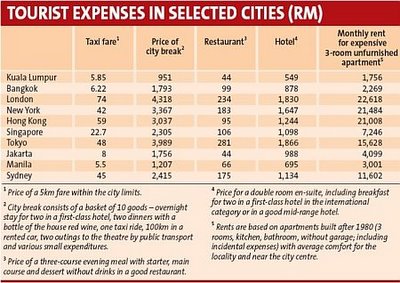

Kuala Lumpur is the least expensive city in the world for Western tourists.

Kuala Lumpur is the least expensive city in the world for Western tourists.A survey of 71 cities worldwide by Swiss banking giant UBS found that Malaysia's capital has the most competitive prices when it comes to food, electronic goods, clothes, public transport, hotel rates and entertainment.

* A five-star hotel room in Kuala Lumpur costs an average US$150 (RM551) compared to with US$450 (RM1,647) for a similar room in New York. The most expensive is Tokyo, where the rate is US$510 (RM1,866).

* For a room in a two- or three-star hotel, the rate in Kuala Lumpur is about US$50 (RM183), compared with US$250 (RM915) in New York.

* It found that one only has to pay US$260 (RM951) for the package in Kuala Lumpur compared with US$920 (RM3,367) in New York. The most expensive city in this category is London where the cost is US$1,180 (RM4,318).

* Taxi fares in Kuala Lumpur are also one of the cheapest in the world at US$1.60 (RM5.88) for a 5km trip within the city. A similar trip in New York costs US$11.60 (RM42).

* Food prices in Kuala Lumpur are considerably lower than in other cities, with a three-course meal in a good restaurant costing US$12 (RM44) for one person. (Other sources: City Mayors: Economics)

Tags: UBS, Kuala Lumpur, Travel, Tourist, Hotel, Restaurant, Least Expensive, City Mayors, Economics

Wednesday, October 11, 2006

ASLI Retracts Its Findings

With reference to my earlier blog on 9 Oct, Asian Strategy & Leadership Institute (ASLI) has retracted its findings. ASLI president, Mirzan Mahathir, had said that on re-examining the methodology and conclusions of the report, "ASLI has concluded that there are shortcomings in assumption and calculation that led to conclusions that cannot be vigorously justified."

With reference to my earlier blog on 9 Oct, Asian Strategy & Leadership Institute (ASLI) has retracted its findings. ASLI president, Mirzan Mahathir, had said that on re-examining the methodology and conclusions of the report, "ASLI has concluded that there are shortcomings in assumption and calculation that led to conclusions that cannot be vigorously justified."As a result of ASLI's action, Centre for Public Policy Studies's Director, Dr. Lim Teck Ghee has resigned on his own accord. Dr Lim was a former UN regional advisor and World Bank Senior Political Scientist. He is also a recipient of international academic awards.

In his resignation statement, Dr. Lim says, as Director of the CPPS, he takes full responsibility, and stands by the findings of the study and the other studies that were submitted in a comprehensive report to the Government on the 9th Malaysia Plan in February 2006. However, Dr Lim adds that since he cannot agree with Mirzan's statement, and because of the need to defend the position and integrity of independent and non-partisan scholarship, he will be stepping down from his position as Director at the end of October.

(source: Screenshots & Malaysiakini)

Tags: Asian Strategy & Leadership Institute, ASLI, Centre for Public Policy Studies, CPPS, 9th Malaysian Plan, Mirzan Mahathir, Methodology

Sunday, August 13, 2006

The World Must Prepare For America's Recession

The US recession will be triggered by three unstoppable forces: the housing slowdown; high oil prices; and higher interest rates. The US consumer, already burdened with high debt and falling real wages, will be hard hit by these shocks. (Source: ytlcommunity)

Are you ready for another recession? I have face 2 of them previously, mid 80s and end 90s. I survived. Be wise/careful with your spending and loans obtained. You may say that it's in the US only..... well, there will be a domino's effect for sure.

Tags: US Federal Reserve, Recession, Economics

Pattaya International Fireworks Festival

Pattaya is definitely firing up its presence internationally. Covid19 has hit many nations really hard and Pattaya wasn't exempted from ...

-

Hari Raya Puasa is also commonly known as Hari Raya Aidilfitri. In Malay, the word Hari Raya means ‘A Day Of Celebration’ and Puasa derives ...

-

News came from Santa Barbara, California — During a search for evidence at the Neverland Valley Ranch , investigators discovered a corpse t...